Building Credit as a Student: 5 Credit Card Tips You Can't Miss

Building credit as a student is not just a financial necessity; it’s a gateway to future opportunities. A good credit score can help you secure loans for cars or homes, get better interest rates, and can even impact your ability to get a job. However, starting your credit journey while juggling classes and assignments can seem daunting. In this article, we'll explore five essential credit card tips tailored for students to help you build your credit score wisely and responsibly.

By following these tips, you’ll not only establish a strong credit history but also learn critical financial management skills that will serve you well in the future. Let’s dive into the details and set you on the right path to financial success.

1. Start with a Secured Credit Card

For students new to credit, starting with a secured credit card can be an excellent option. These cards require a cash deposit that serves as your credit limit, reducing the risk for the lender. This makes them easier to obtain, even if your credit history is limited or nonexistent.

Using a secured credit card responsibly allows you to build a positive credit history over time, which can be crucial for future financial endeavors.

- Research and choose a secured credit card with low fees.

- Make a cash deposit to establish your credit limit.

- Use the card regularly for small purchases and pay the balance in full each month.

Once you’ve established a good payment history, you may be able to transition to a traditional unsecured credit card with better rewards and benefits.

2. Understand the Credit Card Terms

Before you apply for a credit card, it’s important to thoroughly read and understand the card’s terms and conditions. Key elements to look out for include the interest rate (APR), fees, and rewards structure. Understanding these elements can prevent you from incurring debt and unexpected expenses.

Many students overlook the fine print or feel overwhelmed by it. However, knowledge of these terms can empower you to use your credit card more effectively and avoid pitfalls.

- Annual fees and how they apply.

- The grace period for payments.

- Foreign transaction fees if you plan to travel.

By being well-informed about a credit card’s terms, you are equipping yourself to make savvy financial decisions that will benefit you in the long run.

3. Use Your Credit Card Responsibly

Using your credit card responsibly is one of the most crucial aspects of building credit. It’s easy to be tempted to overspend, especially when it comes to discretionary purchases. However, keeping your spending in check will help you maintain a positive credit score.

Make it a habit to create a budget that outlines your monthly income and expenses. This will help you determine how much you can afford to spend on your credit card each month.

- Only charge what you can pay off each month.

- Set up alerts for payment due dates to avoid late fees.

- Keep your credit utilization ratio below 30% of your credit limit.

By taking these steps, you not only protect your credit score but also develop strong financial habits that will benefit you in the years to come.

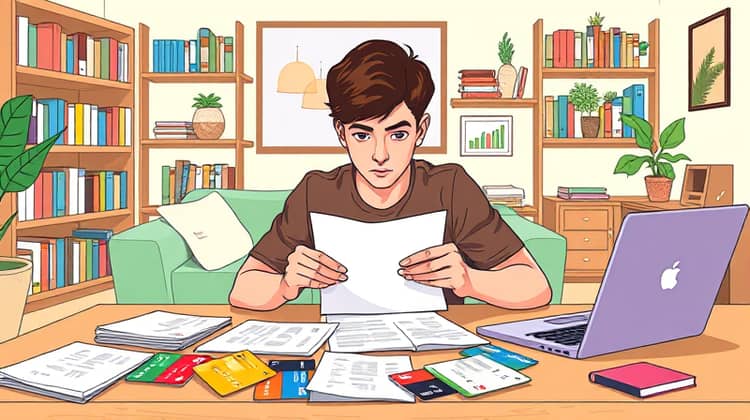

4. Monitor Your Credit Score

Keeping track of your credit score is vital as you begin to build your credit history. Many credit card issuers provide free access to your credit score and updates on your credit report. Regular monitoring can help you understand how your actions affect your score and identify any discrepancies.

Staying informed about your credit score can alert you to potential identity theft or errors, allowing you to address them before they cause long-term damage.

- Use free credit score tracking services online.

- Check your credit report annually for inaccuracies.

- Review your score before making significant purchases.

By consistently monitoring your credit score, you’ll gain valuable insight into your financial health and be better prepared for future financial decisions.

5. Know When to Upgrade

After responsibly using your secured credit card for a period, it may be time to consider upgrading to a traditional credit card. This transition can unlock better rewards, lower interest rates, and additional perks that cater to your spending habits.

However, it's essential to assess whether you are financially ready for an unsecured credit card and to understand how credit limits work.

- Ensure you have maintained a positive payment history for at least six months to a year.

- Research traditional credit cards that offer benefits aligned with your spending habits.

- Apply for a card only when you are confident in your ability to pay off the balance each month.

Ultimately, upgrading your credit card can greatly enhance your credit-building journey, giving you better financial tools as you progress.

Conclusion

Building credit as a student may require patience and diligence, but implementing these five tips can set you up for success. Starting with a secured card, understanding terms, using credit wisely, monitoring your score, and knowing when to upgrade are all vital steps in building a solid financial foundation for your future.

As you embark on this journey, remember that credit isn’t just about numbers; it’s a reflection of your financial responsibility and can significantly impact your life ahead.